Linear motion components include everything from various types of linear actuators to linear guides, slides and ways, and a host of components in between. One thing they all have in common is that their development and production are influenced by both technological trends as well as broader market forces. One of those forces is has been the coronavirus pandemic. The pandemic has impacted every aspect of life, including many segments of manufacturing.

Not surprisingly, one area that has seen growth during the pandemic is laboratory automation. For the past two years, we have been working with laboratory equipment OEMs in the fight against COVID. We’ve been developing precision sample handling and vial capping/decapping solutions based on multi-axis motion systems. We’ve also devoted significant resources to the development of precision liquid handling systems.

Precision liquid handling in automated laboratory devices involves rapid, precise aspiration and dispensing of fluids into and out of vials and microwell plates. New products open- and closed-loop pipettes and pipette heads, new valves and valve controllers, and compact all-in-one compressed air and vacuum generators for onboard air. The partnership between the automation supplier and OEM allows the equipment manufacturer to focus on the science of the test or assay while the automation supplier innovates the motion of handling and liquid dispensing.

We also see increased activity in laboratory automation. This is one of our major industries, with customers always looking for low-cost, lightweight and self-lubricating bearing systems in these environments.

Aside from laboratory automation, other growth areas in automation include battery production as well as food and beverage manufacturing. Automation in battery production drives down cost through higher productivity and is in response to the transition to electric vehicles. Food and beverage automation is driven by a desire to lower worker density on the processing and packaging floor for a safer environment and to compensate for labor shortages. Food handling is stimulating development of new gripping solutions both in soft grippers and adaptable grippers. Research continues on the application of agricultural automation in terms of self-guided mobile robotic picking systems for delicate fruits and vegetables.

Also, as automation technology has become more affordable and increasingly easy to use, smaller manufacturers have embraced automation as a response to the pandemic, especially given labor shortages.

The pandemic has also caused many supply chain issues. In fact, the prospect for further supply chain disruptions into 2022 is all but given. Supply issues top nearly everyone’s list of concerns. You can deal with pricing fluctuations. If you do not receive product, you’re in deep trouble. As a result, people are becoming more resourceful and are doing their best to cope with the uncertainty. Many end users and suppliers build up inventories of crucial components. Companies focus on their approved components books by identifying slides, actuators, and other components that are readily available. Their suppliers must demonstrate to these companies that they have the ability to maintain supply. Years ago, we identified the 20% percent of its product catalog that satisfies 80% of application needs and created the Stars of Automation core products initiative. Starred core products are globally forward deployed and always in stock. This has been a lifeline for many customers during the current disruption.

On the flip side, a key trend that has emerged from the pandemic is the automation of design and ordering through free online tools. Many companies offer these online tools as a way to engage customers and expand their reach. We recognize that with such online tools available, the faster a company can design and place an order for a gantry system, for example, the quicker it can place into the order queue. The same goes for transparent online ordering that provides near instantaneous answers to questions such as: Is the component in stock? When will it ship? What does it cost? When can I receive technical drawings?

Overall, some familiar trends continue for linear motion components such as linear guides, slides, and ways. For instance, it’s still the case that designers want more compact components in order to build smaller machines. Shrinking the size of guides and slides increases component density, while expanding machine production capability. Even though components are smaller, guide and slide performance have to be equal to or better as compared to larger units.

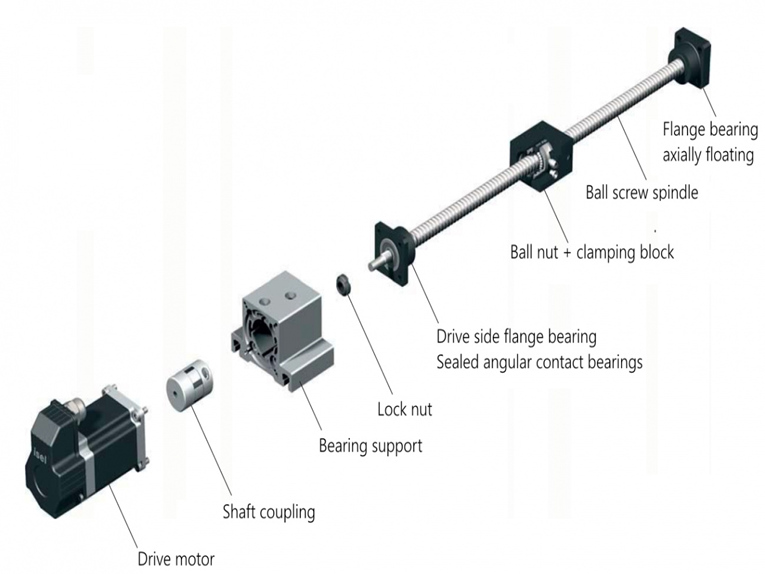

We have introduced a compact slide for precision handling, press fitting, pick and place, and light assembly applications. This slide and yoke plate were machined from a single piece of aluminum, which ensured stiffness and accurate alignment. Backlash free piston rod/yoke connection contributed to the slide’s precision and extended service life.

We see a related trend towards lighter components in linear motion applications. The trends are towards light-weight components, especially those that do not require maintenance. Also, customers are asking for linear components that are quieter, especially if they are being used in commercial or laboratory environments. The trend to small, lighter in weight components has caused other shifts in materials. For example, air preparation units have traditionally been constructed of cast aluminum. Today, there is a transition to high strength polymers.

Post time: May-16-2022